Policies & action

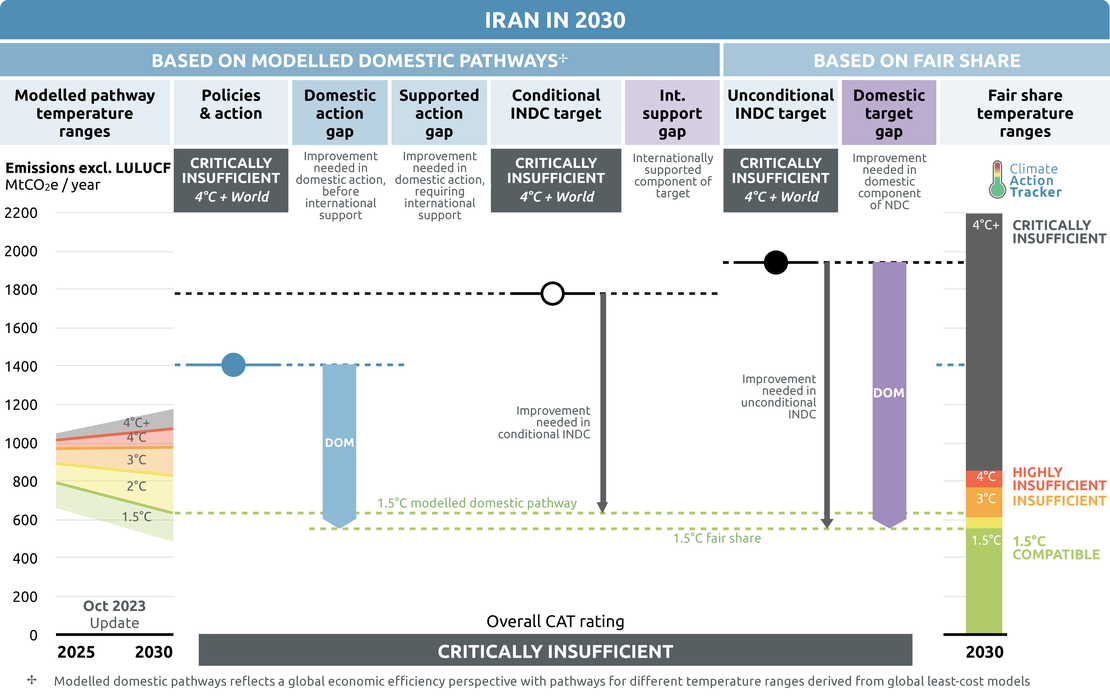

The CAT rates Iran’s policies and action as “Critically Insufficient” when compared to its fair share. Iran’s current policies are sufficient to overachieve both the conditional and unconditional INDC targets, as these targets are based on highly inflated emissions growth projections. Iran needs to implement more stringent policies, but it will also need additional support to do so.

The “Critically insufficient” rating indicates that Iran’s policies and action in 2030 reflect minimal to no action and are not at all consistent with limiting warming to 1.5°C. If all countries were to follow Iran’s approach, warming would exceed 4°C.

Further information on how the CAT rates countries (against modelled pathways and fair share) can be found here.

Policy overview

Iran is expected to significantly overachieve its intended Paris Agreement targets, both conditional and unconditional, with currently implemented policies. One reason for this is the highly inflated business as usual (BAU) scenario used as a basis for the target. Under current policies, we expect Iran’s emissions to reach between 1,404 and 1,409 MtCO2e in 2030 (excluding LULUCF). This represents a 77 to 78% increase compared to 2010 levels.

Analysis shows that energy consumption could be reduced by 40% compared to BAU estimates in 2030 with energy efficiency measures alone, which would also lead to significant emissions reductions (Moshiri & Lechtenböhmer, 2015). Emissions could further decrease with the deployment of renewable energy and other cost-effective mitigation measures (Yetano Roche et al., 2018).

Iran’s capacity to address climate change has been hindered by enduring economic sanctions. Investments in key mitigation technologies, such as renewable energy, picked up during the absence of international economic sanctions in 2015–2018 following the Iran nuclear deal (Lumsden, 2019). However, it significantly slowed down from 2018, when the US withdrew from the agreement and reimposed sanctions on Iran. The Iranian government made it clear in its intended Paris Agreement pledge that its mitigation objectives are conditional on an absence of international economic sanctions (Department of Environment of Iran, 2015). While the government has recently put forward a new renewable energy target, it remains unclear to what extent Iran will be willing or able to pursue mitigation policies under these conditions.

In May 2023, the Iranian government unveiled the bill of the Seventh Five-Year Development Plan, a strategic document which serves as a guiding framework for annual budgets and policy developments. Unlike the previous edition, the new plan is exclusively focused on addressing Iran’s pressing economic challenges (The New York Times, 2023a) and is completely devoid of mitigation measures and renewable energy targets. The government even decided to leave out the section on environmental policy, sending a clear signal about its top priorities.

Sectoral pledges

In Glasgow, a number of sectoral initiatives were launched to accelerate climate action on methane, the coal exit, 100% EVs and others. At most, these initiatives may close the 2030 emissions gap by around 9% — or 2.2 GtCO2e, though assessing what is new and what is already covered by existing NDC targets is challenging.

For methane, signatories agreed to cut emissions in all sectors by 30% globally over the next decade. The coal exit initiative seeks to transition away from unabated coal power by the 2030s or 2040s and to cease building new coal plants. Signatories of the 100% EVs declaration agreed that 100% of new car and van sales in 2040 should be electric vehicles, 2035 for leading markets. On forests, leaders agreed “to halt and reverse forest loss and land degradation by 2030”. The Beyond Oil & Gas Alliance (BOGA) seeks to facilitate a managed phase-out of oil and gas production.

NDCs should be updated to include these sectoral initiatives, if they're not already covered by existing NDC targets. As with all targets, implementation of the necessary policies and measures is critical to ensuring that these sectoral objectives are actually achieved.

| IRAN | Signed? | Included in NDC? | Taking action to achieve? |

|---|---|---|---|

| Methane | No | N/A | No |

| Coal exit | No | N/A | No |

| Electric vehicles | No | N/A | No |

| Forestry | No | N/A | No |

| Beyond oil and gas | No | N/A | No |

- Beyond oil & gas: Iran is not a member of the ‘Beyond oil & gas alliance’. On the contrary, Iran plans to significantly expand its oil & gas production in the coming years.

Energy supply

General — emissions and consumption

Iran’s energy sector is dominated by fossil fuels, which represented 98% of Iran’s total energy supply in 2021 (IRENA, 2022a). It is also the highest emitting sector of the economy, amounting to nearly 90% in 2021 (Gütschow & Pflüger, 2023). Energy industries are the largest emitting sub-sector, followed by fugitive emissions (such as gas flaring), transport and buildings.

Due to the wealth of fossil fuels in combination with government subsidies, Iran’s energy consumption is comparatively high, with consumption per capita far above regional and global averages (World Bank, 2023b).

Oil and gas industry

Iran, a member of OPEC, has some of the world’s largest fossil fuel reserves: it ranks second in fossil gas and third in global oil reserves (US EIA, 2022). Iran holds almost 17% of the world’s proven fossil gas reserves in 2021 (BP, 2023). In 2021, the IEA (2021b) projected that for Iran to reach net zero emissions by 2050, there should be no investments in new oil and gas fields. Despite this warning, Iran has been pursuing investments in the sector, raising concerns over potential stranded assets.

In 2020, Iran was the world’s ninth biggest crude oil producer, despite US sanctions significantly reducing oil exports (EIA, 2021). Fossil fuel resources remain the backbone of the Iranian economy and one of the government’s main sources of revenues. Oil revenue accounted for 18% of Iran’s GDP in 2021(World Bank, 2023b). The government has made some efforts towards diversification from its dependence on oil exports (Jalilvand, 2017), but this has not necessarily led to more climate-friendly developments. Due to the risk of sanctions, Iran has moved to consume more of its fossil fuels domestically (BP, 2020; Jalilvand, 2017). Most of Iran’s fossil gas is consumed domestically.

Despite international sanctions, Iran’s gas production has steadily increased over the last decade (US EIA, 2022). However, the country is currently grappling with a fossil gas shortage, partly due to high domestic demand, chronic underfunding in the sector, and storage capacity shortage. Despite its vast fossil gas reserves, Iran is struggling to meet domestic demand, and is unable to modernise its industry due to economic sanctions (DW, 2023).

Gas flaring remains a major source of emissions in Iran. Despite a slow decrease in recent years, gas flaring increased by 30% between 2020 and 2021(Jafari et al, 2023). In 2022, the country ranked as having the world’s third highest flaring volumes (Global Gas Flaring Reduction Partnership, 2023). The bill of the Seventh Five-Year Development Plan (2023-2027) does not include any targets for gas flaring (The Islamic Republic of Iran, 2023).

Electricity sector developments

Iranian electricity generation is dominated by fossil fuels. In 2021, fossil gas and oil generated nearly 95% of Iran’s electricity was generated with , with the remainder generated with hydropower (4%) and nuclear energy (1%) (US EIA, 2022). The share of electricity derived from fossil fuels has increased by 3% between 2019 and 2021. While the Sixth Five-Year Development Plan (2017–2021) included a few policies designated to reduce emissions in the electricity sector, the bill of the Seventh Five-Year Development Plan (2023–2027) has none (The Islamic Republic of Iran, 2023). Iran does not currently plan to reduce electricity generation from oil and fossil gas.

Iran’s electricity demand has surged in recent years, due to several factors including population growth, subsidised electricity prices and fossil gas supply shortages (US EIA, 2022). Iran’s grid is struggling to keep up with rising demand as it is overstretched and underfunded, a situation worsened by economic sanctions and ageing infrastructure. Energy intensive industries such as cement, steel and crypto mining have further exacerbated these vulnerabilities (The New York Times, 2023b). This has led to several widespread power outages (France 24, 2023).

Renewable energy

Iran has vast untapped renewable energy resources, particularly in terms of solar power. In 2022, the Iranian Energy Ministry announced that it will add 10 GW of renewable energy capacity by 2025, as part of a wider plan to deploy 30 GW of renewable energy generation by 2030 (PV-Magazine, 2022). However, there is no official documents and reliable sources that can confirm progress towards this target.

Iran’s Renewable Energy and Energy Efficiency Organization (SATBA) signed an MOU with private investors to achieve this target and announced that it would allocate around IRR 30tn (approximately USD 71m) to the first set of projects (Power Technology, 2022). SATBA has claimed to have received numerous requests for projects, in total amounting to more than 90 GW (Tehran Times, 2022). However, there is no information available on the progress of these projects and it remains unclear whether the budget was allocated.

Current levels of installed renewable energy capacity remain low, with only 0.8GW of installed total renewable energy capacity from wind and solar in 2021 (IRENA, 2022b). Investments in new capacity have largely stalled as a result of economic sanctions. The Seventh Five-Year Development Plan does not include any renewable energy targets.

A source of uncertainty in the sector lies in electricity produced from hydropower. Iran has a significant amount of hydropower—13 GW in 2020 (IRENA, 2022a)—but the production of electricity has been fluctuating due to changes in precipitation. Severe droughts, which have become more frequent in the last few years, regularly lead to power outages in areas supplied by hydroelectric plants. In 2018, production from hydropower was down 36% compared to 2017, prompting the government to cancel many planned projects (Lumsden, 2019).

Nuclear energy

Nuclear energy continues to play a small role in the Iran’s electricity mix, with just 0.9GW of installed capacity (World Nuclear Association, 2023). There is however another 1.1GW reactor currently under construction, with operation planned to start in 2024.

Transport

Iran has one of the world’s highest-emitting transport sectors, ranking tenth highest in 2014 (Gabbatiss, 2020; Wang & Ge, 2019). Transport emissions accounted for roughly a fifth of Iran’s emissions in 2010 (Department of Environment of Iran, 2017). Iran’s Third National Communication of 2017 includes different mitigation measures for the sector. Iran has notably set a target to double passenger rail transport capacity from 17 billion to 34 billion passenger-kilometres per year and to increase freight rail capacity from 22 ton-kilometre per year to 76 ton-kilometre per year in 2024.

Iran’s Third National Communication of 2017 includes plans to introduce 27,000 buses and 500,000 long-range taxis powered with compressed natural gas (CNG). It also has a target to replace 400,000 gasoline-powered motorcycles with electric bikes and 450,000 gasoline-fuelled pickups and 500,000 diesel trucks with CNG pickups and trucks. There is however no clear timeline nor implementation plan for these measures. With the rapid development of electric vehicles, the strategy to move to CNG is outdated.

The aging fleet of private vehicles is further adding to the carbon intensity of the transport sector (Financial Tribune, 2018). The car market remains dominated by fossil fuel cars and there are no comprehensive measures to promote electric vehicles or zero emissions fuels.

Buildings

Iran has laid out initial plans to reduce the energy use and improve the energy efficiency of its buildings stock. The Sixth Development Plan (2017–2021) sets a target to reduce the energy use of buildings by 5% by 2021 (IEA, 2021a). It is unclear whether Iran has reached its target.

The bill of the Seventh Five-Year Development Plan did not include any mitigation measures for the building sector.

Industry

Emissions from industrial processes and product use (IPPU) represented 6% of total emissions in 2021 (Gütschow & Pflüger, 2023). Combined with energy use from manufacturing industries and construction, total emissions from industry represent nearly a fifth of emissions. Mitigation measures set out in the Third National Communication include replacing part of the clinker used for cement production with industrial by-products, including blast furnace slag, and by replacing oil as a feedstock with natural gas in some industrial applications. These measures are to be implemented by 2025, but there is no detailed timetable.

The bill of the Seventh Five-Year Development Plan did not include any mitigation measures for the industrial sector.

Agriculture

Agriculture is a main component of the Iranian economy, representing around 12.5% of GDP (World Bank, 2023b). In 2010, the sector still represented over 5% of total emissions, but this share has since decreased to 3.5%, both due to a slight decrease in absolute emissions but also due to increases in emissions in other sectors (Gütschow & Pflüger, 2023).

Livestock, paddy fields, burning of crop residues, and agricultural soil are the four major sources of emissions in the sector (Department of Environment of Iran, 2017). Measures to decrease emissions in the sector include an improved manure management, for example with biogas recovery systems, improving livestock productivity to decrease emissions from enteric fermentation, and by reducing emissions from agricultural soils. These measures are to be implemented by 2025, but there is no detailed timetable.

The bill of the Seventh Five-Year Development Plan did not include any mitigation measures for the agricultural sector.

Forestry

Iran’s Third National Communication to the UNFCCC includes a target to decrease the net emissions of the forestry sector from 21.6 MtCO2e in 2010 to 16.6 MtCO2e in 2025 (Department of Environment of Iran, 2017). To achieve this, Iran aims to reduce illegal wood harvesting, forest, and rangeland conversion by 20% yearly, decrease annual wood harvesting for fuel by 10%, and to increase forest rehabilitation, afforestation, and reforestation. In 2020, forests represented 7% of Iran’s total land area, up from 6% in 1990 (World Bank, 2023b).

Further analysis

Latest publications

Stay informed

Subscribe to our newsletter